1st Nov 2021

Cloud storage lies at the foundation of a number of increasingly business-critical applications. Between the rise in demand for digital services, the increase in data from Internet of Things (IoT) connected devices, and the need for cloud services to support remote working during the COVID-19 pandemic, cloud data storage and analytics services have become ever-more crucial across a range of sectors, driving interest in cloud stocks.

Big data is changing the world

Big data refers to data sets that are too large or complex for traditional data processing applications. While advanced tech firms tackle the task of extracting actional data from the growing sea of digital information, the cloud provides crucial hosting and access to bridge between users and providers.

Improving services for BFSI

The banking, financial services, and insurance (BFSI) industry is one of the main sectors enjoying the benefits of big data as made possible by cloud computing. Fast and powerful analytics engines use artificial intelligence (AI) and machine learning (ML) to spot anomalies in enormous datasets within nanoseconds, enabling financial institutions to detect fraud with more accuracy and speed than ever before.

Loan applications, credit ratings, and insurance premiums can be assessed and approved within minutes, saving time and frustration for consumers and raising confidence for financial companies.

With the help of cloud computing, BFSI companies can also extend access to digital payments, supporting mobile and contact-free payments for a number of companies without compromising on security.

Connecting healthcare

Cloud-powered big data is also actualizing the dream of connected healthcare. Physicians can share medical imaging and consult with each other remotely; medical practitioners can use AI to recommend the most appropriate treatments for patients; and hospitals and clinics can gain a better understanding of which services are most needed now and in the future.

Integrating supply chains

Cloud data is helping manufacturing industries integrate supply chains and improve overall operating efficiency. For plants working with time- and temperature-sensitive materials, such as pharmaceuticals, chemicals, and food and beverage (F&B) verticals, cloud data management and analytics opens up visibility into logistics that helps ensure the quality of raw materials and thus their final product.

Meeting consumer needs

The rise of digital services and growing consumer demands for personalized services and products also requires improved access to big data insights. Business to Consumer (B2C) companies need AI and ML services so they can respond to customers by name, stay ahead of fast-moving trends, and deliver customer portals and apps. However, they can’t afford the powerful on-premises data centers and advanced analytics that the giants have been using.

Supporting remote work

Finally, the COVID-19 pandemic played a key role in accelerating adoption of cloud computing solutions. The shift to remote work provoked a call for cloud-based storage options and Software as a Service (SaaS) tools, so a dispersed workforce could remain connected and collaborate smoothly and securely. In the words of Sid Nag, research vice president at Gartner, “The events of last year allowed CIOs [Chief Information Officers] to overcome any reluctance of moving mission critical workloads from on-premises to the cloud.” He added “It will be a disruptive market, to say the least.”1

Why the cloud?

As big data turns into enormously huge data, even companies with well-provisioned data centers feel things spiraling out of control. Datasets have become too large for them to handle, particularly unstructured data from videos, still imaging, and audio recordings, which take up a lot of space and can’t be easily quantified, but can hold immense value.

Scalable and affordable

Relocating data storage to the scalable cloud is the answer. By using public cloud services, even smaller companies with simpler information infrastructure can access the same sophisticated compute power enjoyed by giant corporations at a fraction of the cost. Infrastructure-as-a-Service and GPU-as-a-Service are among the cloud-based solutions that offer flexible, affordable data management on a pay-as-you-go basis, making it flexible, affordable, and scalable.

Moving data storage to the cloud also helps remove silos between departments and datasets, allowing analytics tools to work with the full data picture instead of just isolated sections. Cloud data storage can support frequent updates and database imports, enabling companies to keep their data relevant and refresh it in real time, for more accurate results.

Powerful analytics

Data storage is just one part of the equation; advanced AI and ML-based analytics that can cope with enormous datasets is another part. Cloud data analytics enable every company to understand and action complex unstructured datasets. Cutting edge AI technologies like natural language processing, tongue processing, automated reasoning, and deep neural networks are possible with cloud systems.

Once again, cloud-based “as a service” analytics solutions mean that even small enterprises can apply advanced deep learning (DL) to their datasets. Additionally, cloud computing makes data insights available from anywhere, improving sharing and collaboration as well as disaster recovery support and automated software updates. Security, efficiency, and speed all shoot up with cloud data.

The cloud stocks market is growing fast

As companies race to replace on-premise analytics and data centers with cloud storage and tools, Forrester Research concludes “The aggressive move to cloud, already proceeding at a healthy clip before the pandemic, will spike in 2021, yielding even greater enterprise adoption, Please cloud provider revenue and business value.”2

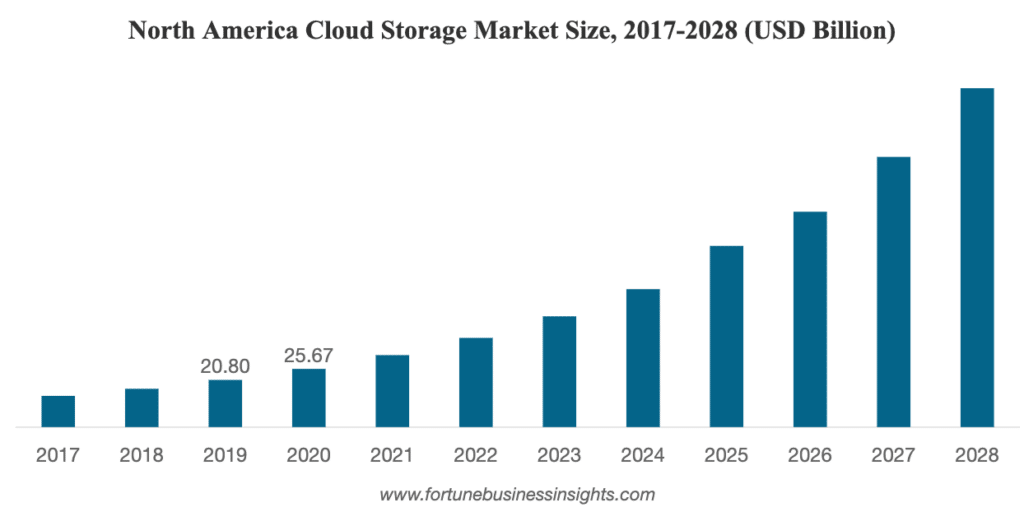

According to Gartner, the greater cloud industry is worth just over $330 billion in global spend this year3, and that’s increasing rapidly. Predictions vary, but Gartner forecasts that public cloud end-user spending will grow 23% to $332.3 billion in 20214, and Fortune Business Insights predicts the market will expand to $390.33 billion in 2028, at aCompound Annual Growth Rate (CAGR) of 26.2%5.

https://www.fortunebusinessinsights.com/cloud-storage-market-102773

As a result, cloud computing stocks are enjoying a resurgence of interest from investors who are looking for growth opportunities and enjoy being part of disruptive technology. Here are 4 top cloud stocks to look at today.

1. Cloudera (CLDR)

Founded in California in 2008 , Cloudera is rated as one of the best cloud stocks to buy by many analysts6. Cloudera offers a suite of cloud data management and analytics solutions including data hubs, data warehousing, ML analytics, and a data platform.

Cloudera recently announced that it is being acquired by Clayton, Dubilier & Rice (CD&R) and KKR in a transaction valued at approximately $5.3 billion7. As of August 24, Cloudera’s stock price is $15.95, up 15.25% since the beginning of the year, with a market cap of $4.72 billion.

2. Snowflake (SNOW)

Snowflake is one of the top cloud stocks for analysts to watch carefully. While stock price fell at the beginning of the year, it’s since rallied, with much depending on Snowflake’s upcoming second-quarter earnings announcement.

Snowflake is a pureplay cloud computing stock, providing cloud software for close to 40% of Fortune 500 companies.8 As of August 24, Snowflake’s stock price stands at $284.47, up over 5% in the past month, with a market cap of $83.32 billion.

3. Teradata (TDC)

Teradata is a relatively long-established data management company, begun in 1979, which is now delivering multi-cloud data management capabilities for real time business intelligence.

The cloud stock received a boost when it announced its Q2 2021 earnings this month, reporting year on year growth in revenue, profitability, and cash flow9. Teradata’s stock price is $53.53 as of August 24, up over 140% since the beginning of the year, with a market cap of $5.84 billion.

4. Defiance Quantum Computing ETF (QTUM)

Defiance, which already has ETFs in a number of disruptive sectors, offers a next-generation computing ETF, QTUM. Though not a pure cloud computing ETF, it seeks to track the BlueStar Quantum Computing and Machine Learning Index. This is a rules-based index that includes equity securities of leading global companies that specialize in the perception, collection and management of heterogeneous big data used in machine learning.

For current performance and holdings, please visit defianceetfs.com/QTUM

1 “Gartner Forecasts Worldwide Public Cloud End-User Spending to Grow 23% in 2021” April 21, 2021 http://gartner.com/en/newsroom/press-releases/2021-04-21-gartner-forecasts-worldwide-public-cloud-end-user-spending-to-grow-23-percent-in-2021

2 “10 Future Cloud Computing Trends To Watch In 2021” November 20, 2020 https://www.crn.com/news/cloud/10-future-cloud-computing-trends-to-watch-in-2021

3 “Why Snowflake is poised to become the facebook of the cloud data storage,” June 28, 2021. https://www.valuewalk.com/snowflake-poised-facebook-cloud-data-storage/

4 “Gartner Forecasts Worldwide Public Cloud End-User Spending to Grow 23% in 2021” April 21, 2021 https://www.gartner.com/en/newsroom/press-releases/2021-04-21-gartner-forecasts-worldwide-public-cloud-end-user-spending-to-grow-23-percent-in-2021

5 “Cloud storage market size, share, and COVID-19 impact analysis” May 2021 https://www.fortunebusinessinsights.com/cloud-storage-market-102773

6 Stock analysis, accessed August 24, 2021 https://stockanalysis.com/stocks/cldr/

7 “Cloudera Enters into Definitive Agreement to be Acquired by Clayton, Dubilier & Rice and KKR for $5.3 Billion” June 1, 2021 https://www.cloudera.com/about/news-and-blogs/press-releases/2021-06-01-cloudera-enters-into-definitive-agreement-to-be-acquired-by-clayton-dubilier-and-rice-and-kkr-for-5-point-3-billion-dollars.html

8 “Is Snowflake Stock A Buy? Software Maker Sets Path To $10 Billion In Revenue By 2028” August 23, 2021 https://www.investors.com/news/technology/snowflake-snow-stock-buy-now/

9 “Teradata stock jumps as Q2 results top expectations, raises year profit view” August 5, 2021 https://www.zdnet.com/article/teradata-stock-jumps-as-q2-results-top-expectations-raises-year-profit-view/