25th Jan 2023

2022 was a mixed year for airline stocks. It began with a strong rebound in travel demand, but that trend was dampened somewhat by hiring challenges, inflation, and border control chaos. The uptick in revenue hasn’t always translated into higher profits, largely due to rising fuel prices, but savvy investors insist that long-term trends are positive, making this an ideal time to look for travel stocks to buy.

Airlines are set to return to profitability

Although 2022 was marked by cancellations, delays, and staff shortages, 2023 could be much smoother. “Most of that is behind us,” said Willie Walsh, director-general of the International Air Transport Association (IATA). “We should be confident that those issues have been resolved.”1

IATA recently published a report predicting that 2023 will see the global airline industry return to profitability for the first time since COVID-19, forecasting a net profit of $4.7 billion, passenger volumes of 4.2 billion travelers, and demand reaching 85.5% of 2019 levels. The report also revised predicted losses for 2022 down from $9.7 billion to $6.9 billion.2

2023 could be the “Goldilocks year” for air travel

Some experts warn that if interest rates continue to rise, it could dampen travel demand for both leisure and business travel3, but Morgan Stanley analyst Ravi Shankar said that 2023 could be a “Goldilocks year” when market conditions are finally “just right.” “The last three years have seen extreme conditions – 2020 and 2021 were ‘too cold’ due to the lingering pandemic and 2022 was ‘too hot’ with pent up demand and inflation,” he said.4

Other markers for airline activity have returned to near to pre-pandemic levels. American Airlines CFO Derek Kerr avers “We continue to believe that 2023 demand for air travel will be robust. We currently see no signs of demand slowing as we move into the new year.”5

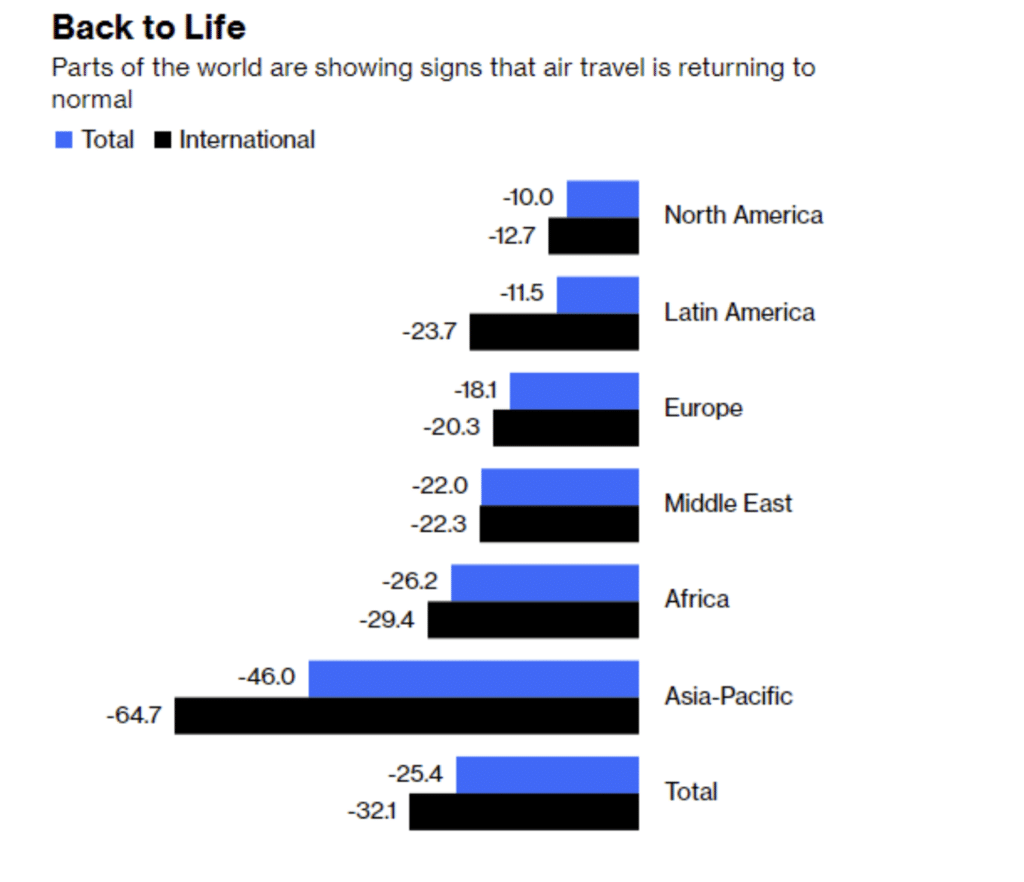

In North America, passenger traffic levels for July 2022 were just 10% below those of July 2019, and in Latin America they fell short by 11%6. Brazil saw a total reversal from a wave of COVID-19 deaths which pushed its largest carrier into bankruptcy, to domestic traffic levels that exceeded those of 20197. “The recovery is going well,” said Walsh, adding that although there will be challenges, “these challenges are relatively small compared to what we’ve come through.”8

For people who share Walsh’s outlook and are looking for attractive travel stocks to buy, here are some of the top airline stocks for 2023.

1. Defiance Travel ETF (CRUZ)

For investors who want to take part in the travel stocks rebound or are considering an airline ETF, but aren’t sure which airline stocks to buy, a travel ETF like Defiance’s CRUZ is an excellent option. By investing in an ETF, you won’t have to predict exactly which airline stocks will see the highest growth, but you’ll still benefit from the long-term return to the skies.

Finance experts recommend investing in a number of stocks across the sector to mitigate your exposure to risk, but that can be difficult for retail investors who don’t have large portfolios. CRUZ ETF is a way to balance your portfolio across the entire travel sector with a single investment.

CRUZ is a travel ETF that tracks the BlueStar Global Hotels, Airlines, and Cruises Index, a rules-based weighted index of airlines, hotel stocks, and cruise companies. CRUZ has an expense ratio of 0.45% and is currently trading at $16.109.

2. Delta Airlines Inc (DAL)

Delta is a well-known international carrier with a stable balance sheet and a market cap of over $21 billion10. It’s already recovering well from the pandemic, with Q3 2022 bringing record revenues of $13.98 billion, up 52.8% from the prior-year quarter and beating market estimates by $360 million11. Delta predicts that strong demand will push fourth quarter revenue even higher to exceed pre-pandemic levels by 5%-9%12.

Delta is widely recommended as a top airline stocks pick13. “As we look into the fourth quarter, there’s nothing that gives me pause to think that this momentum isn’t going to continue,” said CEO Ed Bastien14. Delta is currently trading at $32.7115.

3. Southwest Airlines Co (LUV)

The low-cost carrier Southwest Airlines stands out for its point-to-point business model, low fares, and policy of using just one model of plane to keep maintenance costs low. These practices are bearing fruit as the company leads the post-pandemic revival, making it one of Morgan Stanley’s top airline stocks recommendations16.

It’s the first airline company to reinstate dividends, promising to begin paying a quarterly cash dividend of $0.18 per share as of January 10, 202317. It reported record third-quarter revenues of $6.2 billion, and while capacity is still below pre-pandemic levels, it is predicted to exceed those levels by 10% in 202318.

Southwest Airlines CEO Bob Jordan said “Following record summer leisure travel demand, revenue trends remained strong in September 2022, bolstered by improving business travel trends post-Labor Day.19” Southwest is currently trading at $33.2020.

4. United Airlines Holdings Inc (UAL)

United is a leading North American air carrier serving domestic and international routes. Its third-quarter earnings call reported revenue of close to $13 billion, which beat analyst expectations and outperformed its previous record of $11.4 billion in Q2 2019.

Many analysts placed United on their list of airline stocks to invest in21, and the airline plans to hire 30,000 more employees by the end of 2023 as part of its growth plan. “Despite growing concerns about an economic slowdown, the ongoing COVID recovery trends at United continue to prevail,” said CEO Scott Kirby22. United Airlines is currently trading at $30.0323.

5. Ryanair Holdings PLC (RYAAY)

Ireland-based budget airline company Ryanair, which serves a number of European countries, is a surprise post-pandemic travel success story. The company bucked trends by holding onto most of its staff during the pandemic, which enabled it to capitalize on the travel rebound better than many competitors and earn a new reputation for reliability.

As a result, 2022 saw record passenger volumes for Ryanair, with numbers in August 2022 a full 22% above those of August 201924, and a record 166.5 million customers flying Ryanair in the year ending March 2023.25 “Ryanair is set to maintain an improved relative cost position vs. pre-pandemic,” says Raymond James analyst Savanthi Syth, adding “We believe Ryanair is well positioned to take advantage of further strengthening or possible shocks.26” Ryanair is currently trading at $7527.

1 “Airlines will return to profitability in 2023 after three-year slump, industry body says” December 6, 2022 https://www.cnbc.com/2022/12/06/airlines-will-return-to-profitability-in-2023-after-three-year-slump-iata.html

2 “Airlines will return to profitability in 2023 after three-year slump, industry body says” December 6, 2022 https://www.cnbc.com/2022/12/06/airlines-will-return-to-profitability-in-2023-after-three-year-slump-iata.html

3 “Airline stocks can’t break free from recession anxiety despite positive 2023 setup” December 7, 2022 https://seekingalpha.com/news/3914939-airline-stocks-cant-break-free-from-recession-anxiety-despite-positive-2023-setup “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

4 “Morgan Stanley Says These 2 Travel and Leisure Stocks Are ‘Top Picks’ Heading Into 2023” December 26, 2022 https://finance.yahoo.com/news/morgan-stanley-says-2-travel-092517359.html

5 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

6 “Air Travel Has Almost Recovered. Airlines? Not So Much” September 14, 2022 https://www.bloomberg.com/opinion/articles/2022-09-13/air-travel-has-almost-recovered-airline-stocks-not-so-much?leadSource=uverify%20wall

7 “Air Travel Has Almost Recovered. Airlines? Not So Much” September 14, 2022 https://www.bloomberg.com/opinion/articles/2022-09-13/air-travel-has-almost-recovered-airline-stocks-not-so-much?leadSource=uverify%20wall

8 “Airlines will return to profitability in 2023 after three-year slump, industry body says” December 6, 2022 https://www.cnbc.com/2022/12/06/airlines-will-return-to-profitability-in-2023-after-three-year-slump-iata.html

9 Accessed December 28, 2022 https://www.defianceetfs.com/cruz/

10 “Morgan Stanley Says These 2 Travel and Leisure Stocks Are ‘Top Picks’ Heading Into 2023” December 26, 2022 https://finance.yahoo.com/news/morgan-stanley-says-2-travel-092517359.html

11 “5 Best Airline Stocks To Buy Now” November 8, 2022 https://www.insidermonkey.com/blog/5-best-airline-stocks-to-buy-now-5-1084503/5/

12 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

13 “Morgan Stanley Bullish On Airline Stocks, Names Southwest, Delta Top Picks For 2023” December 5, 2022 https://www.benzinga.com/analyst-ratings/analyst-color/22/12/29959385/morgan-stanley-bullish-on-airline-stocks-names-southwest-delta-top-picks-for-2023 “These are 4 airline stocks to own for 2023 according to Goldman Sachs” December 16, 2022 https://www.investing.com/news/stock-market-news/these-are-4-airline-stocks-to-own-for-2023-according-to-goldman-sachs-432SI-2966344

14 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

15 Accessed December 28, 2022 https://www.google.com/search?q=delta+stock+price&ei=W16sY9Vn-KKR1Q_9h52AAg&ved=0ahUKEwiVgYGWzpz8AhV4UaQEHf1DByAQ4dUDCBA&uact=5&oq=delta+stock+price&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQAzIKCAAQgAQQRhD6ATIFCAAQgAQyBQgAEIAEMgUIABCABDIFCAAQgAQyBQgAEIAEMgUIABCABDIFCAAQgAQyBQgAEIAEMgUIABCABDoICAAQgAQQsAM6BwgAEB4QsAM6CQgAEAgQHhCwAzoFCAAQkQI6CAgAELEDEIMBOgsIABCABBCxAxCDAToRCC4QgAQQsQMQgwEQxwEQ0QM6BAgAEEM6BwguENQCEEM6CgguEMcBENEDEEM6BAguEEM6EAguELEDEMcBENEDEEMQ6gQ6CgguELEDENQCEEM6EAguELEDEIMBEMcBENEDEEM6DQguEMcBELEDENEDEEM6CAgAEIAEELEDOhAILhDHARCxAxDRAxBDEOoEOgoIABCxAxCDARBDOg0IABCABBCxAxCDARAKOgsILhCABBDHARCvAUoECEEYAUoECEYYAFCYB1i5FmCNGGgDcAB4AIAB5AGIAZoVkgEGMC4xNC4ymAEAoAEByAEDwAEB&sclient=gws-wiz-serp

16 “5 Best Airline Stocks To Buy Now” November 8, 2022 https://www.insidermonkey.com/blog/5-best-airline-stocks-to-buy-now-5-1084503/4/

17 “Top Stocks To Buy Now? 3 Airline Stocks In Focus” December 14, 2022 https://www.nasdaq.com/articles/top-stocks-to-buy-now-3-airline-stocks-in-focus

18 “There Is a Lot to Love About Southwest Airlines Stock” December 27, 2022 https://www.investing.com/analysis/there-is-a-lot-to-love-about-southwest-airlines-stock-200633809

19 “There Is a Lot to Love About Southwest Airlines Stock” December 27, 2022 https://www.investing.com/analysis/there-is-a-lot-to-love-about-southwest-airlines-stock-200633809

20 Accessed December 28, 2022 https://www.google.com/search?q=southwest+stock+price&oq=southwest+stock+price&aqs=chrome..69i57j0i512l2j0i22i30l7.2648j1j7&sourceid=chrome&ie=UTF-8

21 “United is still the best airline stock going into 2023, says Cowen’s Helane Becker” December 7, 2022 https://www.cnbc.com/video/2022/12/07/united-is-still-the-best-airline-stock-going-into-2023-says-cowens-helane-becker.html

“These are 4 airline stocks to own for 2023 according to Goldman Sachs” December 16, 2022 https://www.investing.com/news/stock-market-news/these-are-4-airline-stocks-to-own-for-2023-according-to-goldman-sachs-432SI-2966344

22 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

23 Accessed December 28, 2022 https://www.google.com/search?q=united+airlines+stock+price&oq=united+airlines+stock+price&aqs=chrome.0.0i512l7j69i60.5943j1j9&sourceid=chrome&ie=UTF-8

24 “Air Travel Has Almost Recovered. Airlines? Not So Much” September 14, 2022 https://www.bloomberg.com/opinion/articles/2022-09-13/air-travel-has-almost-recovered-airline-stocks-not-so-much?leadSource=uverify%20wall

25 “11 Best Airline Stocks To Buy Now” November 8, 2022 https://finance.yahoo.com/news/11-best-airline-stocks-buy-150958185.html

26 “Watch these airlines in 2023, says Raymond James” December 19, 2022 https://www.marketwatch.com/story/watch-these-airlines-in-2023-says-raymond-james-11671483468

27 Accessed December 28, 2022 https://www.google.com/search?q=ryanair+holdings+stock+price&ei=GGWsY-WwJI2W9u8Pt7OFyAc&ved=0ahUKEwjlnOrM1Jz8AhUNi_0HHbdZAXkQ4dUDCBA&uact=5&oq=ryanair+holdings+stock+price&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQAzIGCAAQBxAeMgQIABAeMgUIABCGAzIFCAAQhgMyBQgAEIYDMgUIABCGAzoKCAAQRxDWBBCwAzoJCAAQsAMQChBDOgcIABCwAxBDOg0IABDkAhDWBBCwAxgBOhIILhDHARDRAxDIAxCwAxBDGAI6BwgAEIAEEA06BggAEB4QDUoECEEYAEoECEYYAVCkBVjgC2DbDWgBcAF4AIABjgGIAaYJkgEDMC45mAEAoAEByAETwAEB2gEGCAEQARgJ2gEGCAIQARgI&sclient=gws-wiz-serp