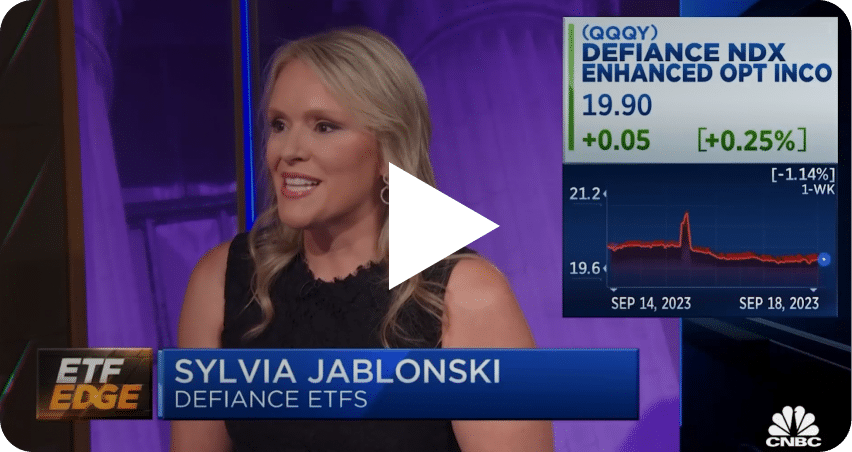

ETFs built for the

next generation

As Seen In

Leading the wave of thematic & income investing

Founded in 2018, Defiance stands as a leading ETF sponsor dedicated to income and thematic investing. Our actively managed options ETFs are designed to enhance income while our suite of first-mover thematic ETFs empower investors to express targeted views on dynamic sectors leading the way in disruptive innovations, including artificial intelligence, machine learning, quantum computing, 5G, and hydrogen energy.

View our ETFs Product Guide