10th Mar 2022

With demand for green hydrogen growing stronger all the time, an international hydrogen market is emerging that is generating new partnerships, opening up new investment and employment opportunities, and adding resilience to the global green energy supply. As well as boosting performance for green hydrogen stocks, new hydrogen trade partnerships could alter the balance of geopolitical power.

The demand for green hydrogen hasn’t yet peaked

With the evidence for climate change all around us, public pressure is growing for governments to meet their carbon neutral targets, industries to decarbonize, and energy companies to divest away from high-polluting fossil fuels. At the same time, the increasing incidence of extreme weather events is stressing energy supply networks, pushing the adoption of green hydrogen microgrids to improve resilience.

As a result, the green hydrogen energy market is set to keep growing for the next several years. By 2040, hydrogen fuel production is predicted to expand by over 200GW globally, or more than a thousandfold1, and even so, demand is likely to outstrip supply2. The global hydrogen generation market size is forecast to exceed $219.2 billion by 2030 at a CAGR of 5.4% from 2021 to 20303.

These trends form the foundations of global trade in green hydrogen.

There are no borders for hydrogen production

Most green energy isn’t easy to transport. Solar, wind, hydroelectric, and nuclear power all need to be situated close to the markets that use them, requiring every region to develop their own infrastructure. However, hydrogen fuel cells are easily transportable, so they can be produced and shipped anywhere in the world.

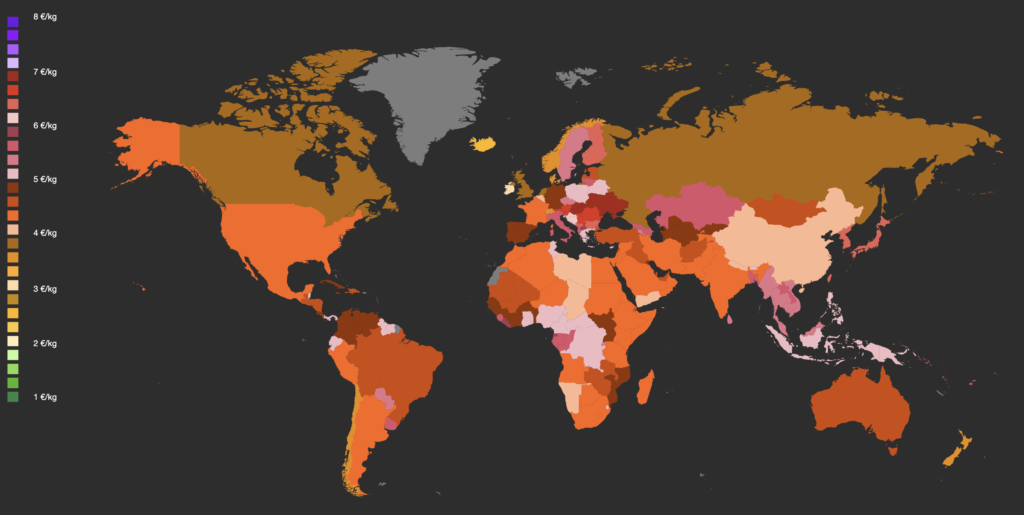

Lowering the cost of green hydrogen production is seen as critical for adoption, adding to the importance of encouraging production in the places where it costs least. The ideal locations for green hydrogen production are sparsely populated with a plentiful supply of renewable energy. In countries without such spaces, like much of Europe, Japan, and South Korea, the cost of producing green hydrogen is double or more what it costs in Africa, Australia, and some parts of the US.4

New market flows will develop

These areas with ideal conditions can become net hydrogen exporters for the rest of the world, helping lower the overall cost of green hydrogen while stabilizing their own economies and creating new jobs at the same time. Over time, we could see the development of a global import-export market for green hydrogen, similar to that for oil and gas, with hubs in strategic locations.

Europe and North Africa are already forming a trading connection. EU member states are committed to cutting greenhouse gas emissions by 55% by 20305 and becoming climate-neutral by 20506, and green hydrogen features prominently in their strategies. Few EU countries have the capacity for large-scale green hydrogen production, and North Africa is a convenient provider. The areas are close enough that green hydrogen can be transported by pipeline, rather than by ship, lowering the cost of imports.

The International Renewable Energy Agency (IRENA) predicts that North Africa could realistically reach 70 GW of wind and 50 GW of concentrated solar power and PV by 20307, which can be used to power green hydrogen production. Last summer’s European Green Deal (EGD) included new partnerships between EU member states and African countries, and the European Clean Hydrogen Alliance aims to secure 40GW of hydrogen imports from non-EU sources by 20308.

In June 2021, Morocco signed a strategic partnership with IRENA to develop its green hydrogen production and grow its participation in the green hydrogen economy. Tunisia and Germany formed the Tunisian-German Alliance for Green Hydrogen, through which Germany provided €31 million for Tunisia to create a pilot hydrogen production unit, advance green hydrogen studies, establish an institutional and regulatory framework, and build its green hydrogen capacity. And Namibia is positioning itself as a green hydrogen production and distribution hub. Its Ports Authority (Namport) signed a Memorandum of Understanding (MOU) with the Port of Rotterdam, which anticipates handling 20 million tons of hydrogen per annum by 20509.

South Africa is also recreating itself as a green hydrogen export hub, with Japan as a likely first customer. Like the EU, Japan plans to be carbon-free by 2050, and intends to import as much as 800,000 tons of green hydrogen per year from 2030. South Africa has high potential for solar and wind energy production, can repurpose existing synthetic fuel production infrastructure and experience, and sits on enormous platinum reserves. Platinum is a key ingredient in hydrogen fuel cell technology, and the World Platinum Investment Council estimates that this could grow into a $2.5 trillion industry by 2050, supporting 30 million jobs10.

Other key hydrogen production hubs could include Australia, Djibouti, Egypt, Ethiopia11, Argentina, Chile, and Saudi Arabia12.

The emerging green hydrogen trade network could change the political power balance

As new players emerge and new partnerships are formed, rising demand for green hydrogen could alter the balance of political power around the world. At a time when Russia’s control over the gas supply means it’s close to being able to hold key European powers to ransom, the new green hydrogen market could have significance that goes beyond economics.

Some of the areas with the best conditions for green hydrogen already wield substantial political power — such as parts of the US and China — or are already energy export hubs like the Middle East and Russia. But others, notably Tunisia, Morocco, Australia, and South Africa, are still relatively minor players on the political stage. It remains to be seen how their status could change by 2050, when the world could need as much as 4,000GW of renewable energy13.

Hydrogen fuel stocks stand to benefit

Whatever changes on the political scene, hydrogen energy stocks are likely to benefit from this long-term demand. Investors are increasingly interested in hydrogen fuel cell stocks and other hydrogen companies’ stock, in the hopes of being part of the sector’s long-term growth.

Instead of hoping to invest in what they think are just one or two of the best hydrogen stocks on their own, many investors are choosing to invest in a hydrogen ETF like Defiance’s HDRO, which allows you to spread a single investment across a number of promising hydrogen energy stocks, so as to help mitigate exposure to this concentration risk while offering the chance to participate in the potential that hydrogen fuel stocks represent.

1 “Hydrogen electrolyser market booms with ‘1,000-fold’ growth in frame by 2040: Aurora” May 11, 2021 https://www.rechargenews.com/energy-transition/hydrogen-electrolyser-market-booms-with-1-000-fold-growth-in-frame-by-2040-aurora/2-1-1009199

2 Global Hydrogen Review 2021 https://iea.blob.core.windows.net/assets/e57fd1ee-aac7-494d-a351-f2a4024909b4/GlobalHydrogenReview2021.pdf

3 “Hydrogen Generation Market Size to Surpass US$ 219.2 Bn by 2030” October 26, 2021 https://www.globenewswire.com/en/news-release/2021/10/26/2321268/0/en/Hydrogen-Generation-Market-Size-to-Surpass-US-219-2-Bn-by-2030.html

4 “The green hydrogen economy: Predicting the decarbonisation agenda of tomorrow” https://www.pwc.com/gx/en/industries/energy-utilities-resources/future-energy/green-hydrogen-cost.html

5 “Climate change: EU leaders set 55% target for CO2 emissions cut” December 11, 2020 https://www.bbc.co.uk/news/world-europe-55273004

6 European Commission: 2050 long-term strategy https://ec.europa.eu/clima/eu-action/climate-strategies-targets/2050-long-term-strategy_en

7 “Green light for a green hydrogen economy in Africa” November 4, 2021 https://african.business/2021/11/energy-resources/green-light-for-a-green-hydrogen-economy-in-africa/

8 “What Does the European Green Deal Mean for Africa?” October 18, 2021 https://carnegieendowment.org/2021/10/18/what-does-european-green-deal-mean-for-africa-pub-85570

9 “Ed’s note: Prospects of green hydrogen in Africa in 2022” December 1, 2021 https://www.esi-africa.com/industry-sectors/future-energy/prospects-of-green-hydrogen-in-africa-in-2022/

10 “South Africa eyes future as green hydrogen hub ” October 27, 2021 https://african.business/2021/10/energy-resources/south-africa-eyes-future-as-green-hydrogen-hub/

11 “Green light for a green hydrogen economy in Africa” November 4, 2021 https://african.business/2021/11/energy-resources/green-light-for-a-green-hydrogen-economy-in-africa/

12 “South Africa eyes future as green hydrogen hub ” October 27, 2021 https://african.business/2021/10/energy-resources/south-africa-eyes-future-as-green-hydrogen-hub/

13 “Green light for a green hydrogen economy in Africa” November 4, 2021 https://african.business/2021/11/energy-resources/green-light-for-a-green-hydrogen-economy-in-africa/