22nd Apr 2022

Hydrogen stocks have been getting a lot of attention for many reasons, including hydrogen’s low environmental footprint and the abundant supply of hydrogen across the planet, but recent news about the potential of hydrogen for energy storage could add to the arguments for investing in green hydrogen stocks.

Why does power storage matter?

One feature of fossil fuels is that they release energy on demand, and can store that energy across extremely long periods of time. As utilities companies respond to public pressure to decarbonize their energy supply, they are struggling to find a stable power storage alternative.

In contrast to fossil fuels, renewable power sources produce power based on the availability of resources, so they are neither consistent nor easily scalable. For example, solar power typically produces more energy in the summer, but demand might be greatest in winter when consumers turn on their heat. Utilities’ companies need an efficient way to capture that excess power, store it, and then release it at will.

As fossil fuels are phased out and dependency on renewables grows, power storage needs are rising. David Roberts, editor of Canary Media, observes that “As the grid shifts from coal and gas to variable, weather-dependent sources like sun and wind, it will need more storage to balance things out and remain stable.1“

Today’s power storage isn’t enough

Current global storage systems are inadequate, storing only around 3-4% of the electricity produced by utilities. Energy storage capabilities need to increase more than threefold to meet the target of keeping global warming below 2℃ by 20502.

Some point to lithium-ion batteries for low-cost, effective short-term shortage, but they empty within just a few hours3, plus there isn’t sufficient lithium supply. Janice Lin, founder and CEO of the Green Hydrogen Coalition, writes “although lithium-ion energy storage is an important part of the toolkit, there is just not enough lithium to support the needs of our clean energy future,” adding “Only abundant, available hydrogen can offer the large-scale storage capacity and flexible discharge horizons to support a global clean energy future.”4>

How hydrogen is used to store power

Green hydrogen, produced using electrolysis powered by renewable energy, is seen as the most cost-effective, accessible, and environmentally-friendly option for increasing global energy storage capacity.

It works by taking advantage of periods of slack demand and using excess solar or wind energy to power the electrolyzers that produce hydrogen fuel. The hydrogen is stored, along with the energy locked within it, and then re-electrified at a future date to release the energy.

Hydrogen is usually stored as a gas, although there is work underway on storing hydrogen as a cryogenic liquid5. Small amounts are kept in pressurized containers, or bonded with metal into solid hydrides, but large amounts are increasingly stored in underground salt caverns, which cost 10 times less than aboveground tanks and 20 times less than hard rock mines6.

According to Martin Robinius, deputy director of the Institute of Energy and Climate Research in Germany, “without implementation of hydrogen salt caverns, there’s no cost-optimal pathway to achieve our climate goals.7“

Hydrogen salt caverns are already in use in Germany, France, the UK, Ireland, the Netherlands, and the US. In Utah, for example, Mitsubishi Power Americas is working with Californian green energy providers to store excess power in up to 100 salt caverns, each of which can hold as much as 150,000 MWh of energy8.

The benefits of hydrogen power storage

Once you bring hydrogen into the picture, drastically reducing the risk of power outages at times of peak demand, renewable energy becomes practical on a large scale. “California curtailed between 150,000-300,000 MWh of excess renewable energy per month through the spring of 2020, yet saw its first rolling blackouts in August because the grid was short on energy,” says Paul Browning, CEO of Mitsubishi Power Americas9.

“Hydrogen is that one technology where you can actually do seasonal storage,” agrees Paul Schultz of the Los Angeles Department of Water and Power, adding “All of this amount of over-generation that you potentially have in the spring and the fall can be used when you are renewable resource-poor during the summer and the winter.”10

Admittedly, re-electrifying hydrogen to release the power again is relatively low in efficiency, as 40-50% of the hydrogen is lost in the process11, making hydrogen power storage expensive. However, the need to decarbonize the power market is so great that hydrogen’s storage efficacy makes it worth the price.

As Browning points out, green hydrogen may be expensive compared with natural gas, but it’s more competitive than other eco-friendly forms of electricity storage. “The relevant question is: ‘What does it cost relative to other storage technologies?’ And in that sense, it’s very affordable,” he said.12

Hydrogen also offers a way to transport power from renewable energy from areas that are high in the relevant resources to areas that are lacking, such as bringing offshore wind power inland. Otherwise, moving solar or wind power to the areas that need them is highly impractical.

Hydrogen storage capabilities could drive hydrogen energy stocks prices

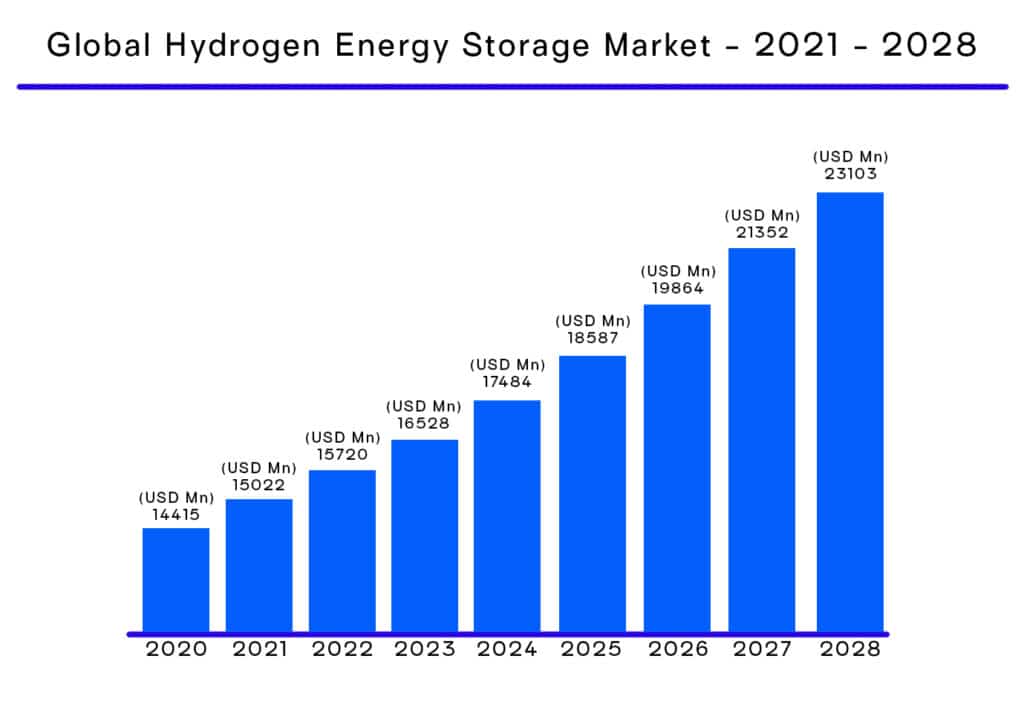

A report by Acumen Research estimated that the hydrogen energy storage market was likely to grow to $23.1 million, at a CAGR of over 6.3%, by 2028, thanks largely to the growing need for hydrogen storage to replace fossil fuels, as well as rising demand for stored hydrogen for use in various power applications13.

Green hydrogen enthusiasts already have plenty of reasons for investing in hydrogen companies’ stock, but this information could make a difference to the decision for people who are curious about this disruptive sector, yet still uncertain about the long-term stability of even the best hydrogen stocks. For these interested yet cautious investors, a hydrogen ETF like Defiance’s HDRO could be more appealing than choosing from a multitude of different hydrogen stocks and other hydrogen companies. The ETF helps spread your investment across many hydrogen stocks with just one investment.

For current performance and holdings, please visit defianceetfs.com/HDRO

1 “Why lithium-ion batteries are so important” April 14, 2021 https://www.canarymedia.com/articles/why-lithium-ion-batteries-are-so-important/

2 “BEYOND THE TIPPING POINT: FUTURE ENERGY STORAGE” https://www.swecourbaninsight.com/urban-energy/beyond-the-tipping-point-future-energy-storage/

3 “Hydrogen: the future of electricity storage?” April 5, 2021 https://www.ft.com/content/c3526a2e-cdc5-444f-940c-0b3376f38069

4 “Green hydrogen: The zero-carbon seasonal energy storage solution” November 2, 2020 https://www.energy-storage.news/green-hydrogen-the-zero-carbon-seasonal-energy-storage-solution/

5 “Want Long-Term Energy Storage? Look to Hydrogen” December 1, 2021 https://www.powermag.com/want-long-term-energy-storage-look-to-hydrogen/

6 “An $11 trillion global hydrogen energy boom is coming. Here’s what could trigger it” december 4, 2020 https://www.cnbc.com/2020/11/01/how-salt-caverns-may-trigger-11-trillion-hydrogen-energy-boom-.html

7 “An $11 trillion global hydrogen energy boom is coming. Here’s what could trigger it” december 4, 2020 https://www.cnbc.com/2020/11/01/how-salt-caverns-may-trigger-11-trillion-hydrogen-energy-boom-.html

8 “An $11 trillion global hydrogen energy boom is coming. Here’s what could trigger it” december 4, 2020 https://www.cnbc.com/2020/11/01/how-salt-caverns-may-trigger-11-trillion-hydrogen-energy-boom-.html

9 “An $11 trillion global hydrogen energy boom is coming. Here’s what could trigger it” december 4, 2020 https://www.cnbc.com/2020/11/01/how-salt-caverns-may-trigger-11-trillion-hydrogen-energy-boom-.html

10 “Hydrogen: the future of electricity storage?” April 5, 2021 https://www.ft.com/content/c3526a2e-cdc5-444f-940c-0b3376f38069

11 “Green hydrogen: The zero-carbon seasonal energy storage solution” November 2, 2020 https://energystorage.org/why-energy-storage/technologies/hydrogen-energy-storage/

12 “Want Long-Term Energy Storage? Look to Hydrogen” December 1, 2021 https://www.powermag.com/want-long-term-energy-storage-look-to-hydrogen/

13“Hydrogen Energy Storage Market Surpass $23,103Mn by 2028 | CAGR 6.3% Report Published By Acumen Research and Consulting” February 2, 2022 https://www.globenewswire.com/news-release/2022/02/02/2377839/0/en/Hydrogen-Energy-Storage-Market-Surpass-23-103Mn-by-2028-CAGR-6-3-Report-Published-By-Acumen-Research-and-Consulting.html