8th Jul 2021

2019 was a blockbuster year for travel, which made the travel drought of 2020 so much more glaring in comparison. The summer of 2020 saw 80% of flights canceled, and industry revenues fell by around 60% to $328 billion1. Global air passenger volume was 64% below that of 20192, and it’s estimated that the sector lost $370 billion in revenue in 20203.

It’s no surprise that airlines stocks underperformed during the past year, but companies that weathered the storm are optimistic about the future4, building on lessons learned from the pandemic. Trends like digital transformation, new collaborations, and other innovations could revolutionize the travel industry and bring a better, stronger travel model for the long term. Vaccine rollout has made an enormous difference to travel stocks, and while the market is still below its pre-COVID level, analysts expect that most airlines could return to profitability in the next year5. Travel ETFs may aim to benefit from such a recovery.

Demand is high, but the direction has changed

The pandemic hasn’t dented enthusiasm for travel. “People still hunger for the experiences that you can only get away from home, such as culture, people, food, sights, et cetera,” says Arne Sorenson, CEO of the Marriott Group. Karen Chan, CEO of Air Asia, agrees, adding “We asked customers, and they told us that they would start flying as soon as possible.”6 The European Travel Commission (ETC) reports that 56% of Europeans are willing to travel by August7.

But that doesn’t mean that nothing has changed. Leisure travel will bounce back long before business travel, as we’ve seen after previous crashes. In fact, industry analysts are wondering if the latter will ever fully recover fully, with McKinsey predicting that it will only reach 80% of pre-pandemic levels by 2024. Business travel still hadn’t returned to pre-2008 levels when COVID-19 hit, and advances in tech and the embrace of remote work might mean that the days of flying to meetings are over.8

Remote work could mean travelers taking longer trips for “workations”, a trend that companies are already noting in their booking data9. All of which requires airlines to become more agile. Airlines that respond quickly to this shift in balance, changing route options in favor of leisure destinations rather than business hubs, replacing frequent flights using smaller aircraft with larger planes traveling less frequently, and reconfiguring cabin layouts for more leisure and premium leisure seats rather than business class, will be among the winners.10

The leisure rebound is likely to be a boon for low-cost carriers, which serve more leisure routes and don’t rely on business travelers. Cash-strapped consumers are looking for the best deals on ticket prices, and low-cost airlines are emerging from the pandemic in a good position. “Although all airlines have drastically reduced costs to weather the storm created by COVID-19, it is evident that low-cost carriers have managed to push already low-cost bases even lower,” said GlobalData travel and tourism analyst Gus Gardner.11

Flight destinations are also changing, with consumers favoring short haul over long haul and domestic flights over international ones. 30% of travelers say they plan to travel more domestically post-COVID-1912.

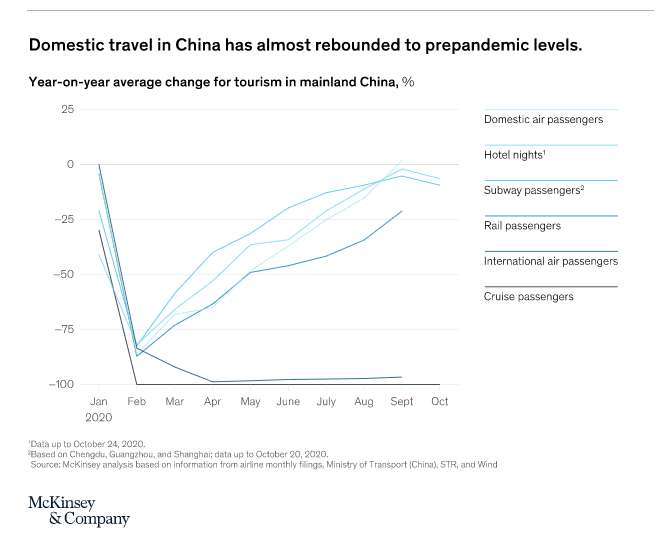

In China, where travel patterns are widely hoped to be a model for the rest of the world, domestic air travel has nearly returned to to its pre-pandemic levels, while in Malaysia, the Philippines, and Thailand, domestic flights are back to 70-90% capacity13.

The US saw an explosion in domestic flights in the past few months, following the success of the vaccine rollout, with companies such as American Airlines, United Airlines, and Delta scrambling to hire more call center staff to cope with demand. The start of the recent Memorial Day weekend saw almost 2 million people take to the skies14, more than on any single day since March 2020, and the number of domestic leisure tickets sold were up 29.5% in comparison to 201915. Some experts think that by July, domestic air fares and capacity in the US could approach pre-pandemic levels16.

The astonishingly swift recovery of domestic travel highlights that customers haven’t abandoned the air. Air executives believe that international flights will bounce back similarly once borders open, saying that all that’s holding them back now is political decision-making. Willie Walsh, director general of IATA, said “The crisis in the airline industry, which was initially caused by a health pandemic, is now really a crisis caused by restrictions being imposed by government.”17

Changes sparked by COVID-19 could drive growth

Crisis is often a catalyst for growth, and we’re seeing that play out in the air industry. Digital transformation, innovation, and new collaborations are reshaping both the passenger experience and airline business models, in ways that could drive the market higher.

Just like in other industries, COVID-19 drastically accelerated digital transformation across air verticals, a change that was long overdue. Before the pandemic, airlines spent approximately 5% of their revenues on IT, in contrast with retail, which spends around 6%, and far behind the 10% invested by financial services18.

Digital vaccine passports and health checks are vital to prevent bottlenecks for travelers. For example, IATA is rolling out the IATA Travel Pass Initiative, for travelers to store their COVID-19 test results and vaccination certificates in a centralized portal for easy access by airlines, border control, and travel companies. Users can manage their data through a smartphone app. So far, 30 airlines and 3 countries have signed up to the scheme.19

The EU expects its new Digital COVID Certificate, which proves the user’s negative COVID status, to drive travel upon introduction in July20. In Africa, airlines are already preparing the digital infrastructure needed to support digital COVID passports, even though it could be late 2022 before 60% of the continent’s population is vaccinated21.

Travel players themselves can do even more to ease the process of border and health checks, such as including COVID-19 test results in reservation systems and inviting customers to import digital results to airline websites, to be shared with their destination’s government body22. We may yet see the Common Pass expand into fully digital passports.

Airlines and other travel companies are investing heavily in digital solutions that go beyond COVID health status to improve passenger experience across the board, recognizing the need to own the customer relationship and reclaim it from third-parties. They are introducing mobile apps that facilitate smooth remote payments and streamlined, contactless check in, security checks, passport control, and boarding.23

Low-cost airlines are heading the field with digital in-flight interactions, such as EasyJet’s app for ordering online meals, drinks, and duty free. The next step is to adopt advanced analytics to support personalized passenger experiences and further refine the relevance of their offering. In China, industry players say that their rapid adoption of new digital channels and innovative experiences has helped drive their travel revival24.

The revolution isn’t just digital. Successful airlines are developing new products and forging new collaborations. In China, for example, airlines introduced a new flexible travel pass that allows unlimited domestic flights within a certain period of time. Qantas began offering sightseeing flights that take off and land in the same airport, but fly past Australia’s main sights at a low level.25

Online travel agencies are forming partnerships with cruise lines and airlines, and executives are exploring new possibilities around logistics and cargo collaborations. We’re seeing a rise in point to point flying rather than layovers and “hub and spoke” flights, which in turn is prompting new relationships between airlines, airport authorities, hotels, and local transportation.

The market is taking note

Although the majority of airlines are in debt, with the industry as a whole owing over $180 billion collectively and rising26, stock prices are responding to the positive outlook. It’s interesting that Airbus announced last month that it will be ramping up production, especially of its smaller single-aisle aircraft which ply short haul routes. Airbus says this is based on its expectation that the commercial aircraft market will regain its pre-COVID levels between 2023 and 2025.27

After America’s astonishing travel rates over Memorial Day weekend, all US airline stocks traded higher. American Airlines was up 1.9%, and Delta, JetBlue, Southwest and United were all more than 1% higher.28

America’s 4 leading carriers are all sounding a positive note, with Delta saying that demand for higher-profit premium seats has outpaced economy seats, and United Airlines reporting that the average fare paid per mile (yields) were trending near or above 2019 levels in some cases29.

Southwest airlines is the only carrier to have added routes during the pandemic. It has a strong balance sheet, giving it plenty of capital to fund innovation and changes.30 Outside of the US, Singapore airlines has one of the best records in 2020, possibly because of its prescient move into cargo services31. Overall, the outlook is positive for the airline sector. Those airlines that can shed debt, renegotiate leases, and restructure themselves going forwards are likely to see high growth over the next few years32. The pandemic dealt it a serious blow, but a number of analysts were already concerned that the market was overheated back in 2019. As course correction goes, 2020 was pretty drastic, but the digital transformation, innovation, and new collaborations that are arising from it could be driving a more sustainable and healthy travel market that has a better long term future.

1 “Back to the future? Airline sector poised for change post-COVID-19” April 2, 2021 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19

2 “Will airline hubs recover from COVID-19?” November 5, 2020 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/will-airline-hubs-recover-from-covid-19

3 Airline passenger revenue loss due to coronavirus outbreak worldwide in 2020, by region of airline registration https://www.statista.com/statistics/1106679/coronavirus-airlines-passenger-revenue-region/

4 “Editorial: Reasons to be optimistic this summer” June 2, 2021 https://www.routesonline.com/news/29/breaking-news/295986/editorial-reasons-to-be-optimistic-this-summer/

5 “Airline Stocks To Buy And Watch As Path To Profitability Emerges: Separate Winners From Losers” May 27, 2021 https://www.investors.com/research/airline-stocks-to-buy-and-watch/

6 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

7 “Most Europeans ‘willing to travel’ this summer” May 7, 2021 https://www.routesonline.com/news/29/breaking-news/295806/most-europeans-willing-to-travel-this-summer/

8 “Back to the future? Airline sector poised for change post-COVID-19” April 2, 2021 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19

9 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

10 “Back to the future? Airline sector poised for change post-COVID-19” April 2, 2021 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19

11 “Low-cost airlines to lead post-COVID recovery: GlobalData” February 23, 2021 https://www.spglobal.com/platts/en/market-insights/latest-news/coal/022321-low-cost-airlines-to-lead-post-covid-recovery-globaldata

12 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

13 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

14“US airlines divided over strength of summer travel rebound” June 2, 2021 https://finance.yahoo.com/m/fffe7160-ed83-3c8a-96cb-36f1e6133db1/us-airlines-divided-over.html

15 “Airline stocks track higher after strong bookings into Memorial Day weekend” June 1, 2021 https://seekingalpha.com/news/3701653-airline-stocks-track-higher-after-strong-bookings-into-memorial-day-weekend

16 “U.S. airlines scramble to find call center staff as travel returns” May 19, 2021 https://www.reuters.com/world/the-great-reboot/us-airlines-scramble-find-call-center-staff-travel-returns-2021-05-19/

17 “IATA Chief Says Governments Prolonging Travel Industry’s COVID-19 Crisis” May 29, 2021 https://www.travelpulse.com/news/impacting-travel/iata-chief-says-governments-prolonging-travel-industrys-covid-19-crisis.html

18 “Back to the future? Airline sector poised for change post-COVID-19” April 2, 2021 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19

19 “Vietnam Airlines signs up for international vaccine passport program” May 31, 2021 https://e.vnexpress.net/news/business/companies/vietnam-airlines-signs-up-for-international-vaccine-passport-program-4286663.html

20 “Greece Reveals First EU Digital COVID Passport as ‘Fast Lane to Facilitate Travel’” May 29, 2021 https://www.schengenvisainfo.com/news/greece-reveals-first-eu-digital-covid-passport-as-fast-lane-to-facilitate-travel/

21 “COVID-19: Africa’s aviation industry suffers massive losses” April 15, 2021 https://www.dw.com/en/covid-19-africas-aviation-industry-suffers-massive-losses/a-57195980

22 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

23 “Back to the future? Airline sector poised for change post-COVID-19” April 2, 2021 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19

24 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

25 “NEF Spotlight: Mapping the travel sector’s recovery” January 26, 2021 https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-mapping-the-travel-sectors-recovery

26 COVID-19 lowers airline credit ratings and raises the cost of debt,” International Air Transport Association, August 21, 2020, iata.org. Cited https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19

27 “Airbus ramps up production as it eyes post-Covid recovery” May 29, 2021 https://www.bbc.com/news/business-57267194

28 “Airline stocks track higher after strong bookings into Memorial Day weekend” June 1, 2021 https://seekingalpha.com/news/3701653-airline-stocks-track-higher-after-strong-bookings-into-memorial-day-weekend

29 “Airline Stocks To Buy And Watch As Path To Profitability Emerges: Separate Winners From Losers” May 27, 2021 https://www.investors.com/research/airline-stocks-to-buy-and-watch/

30 “Investing in Airline Stocks” January 8, 2021 https://www.fool.com/investing/stock-market/market-sectors/industrials/airline-stocks/

31 “Top Airline Stocks for Q2 2021” March 10, 2021 https://www.investopedia.com/top-airline-stocks-5078282

32“Back to the future? Airline sector poised for change post-COVID-19” April 2, 2021 https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/back-to-the-future-airline-sector-poised-for-change-post-covid-19