27th Jun 2023

Work-from-home or work-from-abroad travel.

The world is changing and travel habits are changing with it. Defiance’s CRUZ ETF seeks to provide next generation investors with exposure to the growth potential in the latest travel trends, by tracking the total return performance, before fees and expenses, of the BlueStar Global Hotels, Airlines, and Cruises Index (the “Index”). The travel and tourism industry contributed $8.9 trillion to world GDP in 2019,[1] and revenue is expected to reach US$854.80bn in 2023 with an annual growth rate of 4.4%.[2] Suppressed demand over the last few years is clearly reemerging, with travel companies adapting and responding to capitalize on the growth opportunities now presented by travel-thirsty consumers.

Travel plans on hold

The travel industry, which accounts for 10% of the global economy, was largely put on hold from early 2020, when many countries froze arrivals and closed hotels, culture and entertainment venues. In the first 10 months of 2020 alone, the tourism industry lost $935 billion in revenue worldwide. For the USA, travel and tourism contributed more than $1.1 trillion to the USA’s 2019 GDP with around 80 million international tourists.[3] It then suffered the biggest single drop in tourism revenue: a $147,245 million loss over ten months from the start of 2020. In the cruise industry, the US Center for Disease Control and Prevention (CDC) ordered it to cease operations and world governments imposed sailing restrictions. Business meetings moved to Zoom and thousands of flights were cancelled.

Growing Confidence

But beginning in 2022 and gaining momentum into 2023, travelers are returning to their favorite spots, discovering new horizons and realizing the potential of the workcation.

Consumers are showing their confidence in airline ticket sales, hotel rooms and cruise bookings. A survey for the World Travel and Tourism Council (WTTC) found that 63% of consumers are planning a leisure trip in the next 12 months, with 27% intending to take 3 or more.[4] Hotels and airlines paint a similar picture, with 61% of Americans responding to an American Hotel & Lodging Association (AHLA) survey saying they would take more vacations in 2023 than in 2022 , and the International Air Transport Association (IATA) predicting that 2023 will be the first profitable year for airlines since 2019. Travelers are also spending more at vacation destinations, with inbound tourism spending rising 112% over 2021 levels and predicted to exceed $1.4 trillion globally in 2023. [5]

Business as usual for Hotel stocks and Airline Stocks?

Business travel is more lucrative than leisure travel, but takes longer to recover after a crisis, so investors are taking note of trends among business travelers. Ravi Shankar, Morgan Stanley’s analyst for travel in North America, predicts that 2023 will see business travel budgets nearly back to “normal” and even exceeding 2019 levels. [6]

Indeed the metrics cited above are positive for 2023, so travel investors focusing on airline stocks can take heart. International Air Transport Association (IATA) figures for 2023 point to a promising picture of aviation returning to profitability for the first time since 2019.[7] Delta’s Q1 2023 report for example, forecast Q2 revenue growth and profit beyond analysts’ estimates, as a result of strong travel demand.[8]

In terms of hotel stocks, 2022 ended with occupancy still slightly below 2019 levels, but RevPAR (revenue generated per available room, whether or not they are occupied) and ADR (average daily rate) both exceeding it, which bodes well for any hotel stocks investors.[9] Hotels giant Marriott fits the model, reporting $4.2 billion in revenue Q2 2022, only slightly below 2019 levels, and expecting 2022 RevPAR to end 2-4% above pre-2019 numbers.[10]

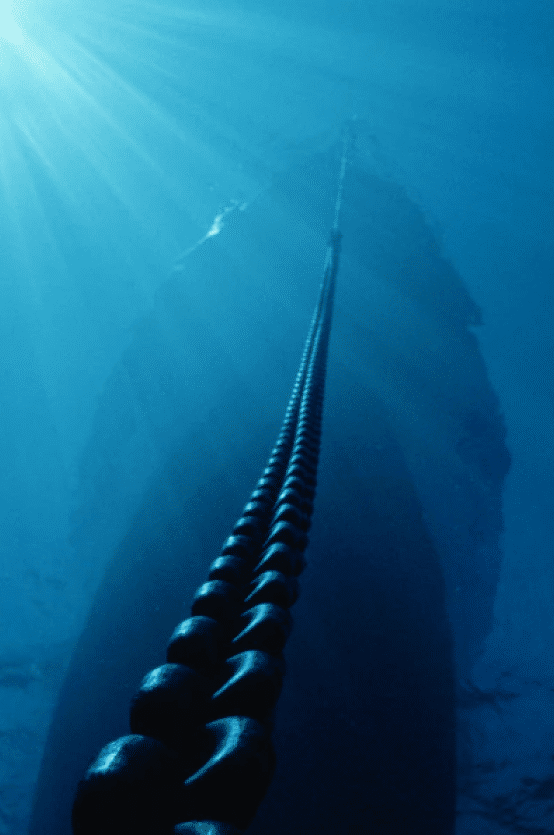

Cruising through the stormy waters

Even some of the best cruise stocks entered 2023 with a significant debt burden, so meaningful returns may take time to arrive. However, customers are returning to cruise ships, helped by the desire for luxury travel. Daniel Kline, managing editor for The Street, writes that “these are strong companies built for the long-term.”[11]

These predictions could make this an excellent time to consider investing in cruise related stocks. Major cruise stocks are still trading 30% or more below pre-2019 levels, but passenger volume in 2023 is expected to exceed that of 2019 by 8%, so investors may wish to buy in the dip. [12]

Holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security

[1] “The Covid-19 Pandemic Has Cost The Global Tourism Industry $935 Billion,” Duncan Madden, January 14, 2021. https://www.forbes.com/sites/duncanmadden/2021/01/14/the-covid-19-pandemic-has-cost-the-global-tourism-industry-935-billion/?sh=7852ded17d40

[2] https://www.statista.com/outlook/mmo/travel-tourism/worldwide

[3] “The Covid-19 Pandemic Has Cost The Global Tourism Industry $935 Billion,” Duncan Madden, January 14, 2021. https://www.forbes.com/sites/duncanmadden/2021/01/14/the-covid-19-pandemic-has-cost-the-global-tourism-industry-935-billion/?sh=7852ded17d40

[4] “Global Traveller Survey Reveals International Travel Is Back” November 28, 2022 https://www.hotel-online.com/press_releases/release/global-traveller-survey-reveals-international-travel-is-back/

[5] “Despite Recession Fears, Tourist Spending Is Expected to Grow in 2023” December 14, 2022 https://www.bloomberg.com/news/articles/2022-12-14/despite-recession-fears-tourist-spending-will-grow-on-in-2023-report

[6] “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.morganstanley.com/ideas/business-travel-trends-2023-outlook

[7]“Airlines Cut Losses in 2022; Return to Profit in 2023,” IATA, December 6, 2022 https://www.iata.org/en/pressroom/2022-releases/2022-12-06-01/

[8] “Delta Air Lines posts quarterly loss but forecasts profit as peak travel season approaches,“ April 13, 2023. https://www.cnbc.com/2023/04/13/delta-air-lines-dal-earnings-q1-2023.html

[9] “7 Best Hotel Stocks to Buy Now” November 22, 2022 https://finance.yahoo.com/news/7-best-hotel-stocks-buy-213048296.html

[10] “7 Best Hotel Stocks to Buy Now” November 22, 2022 https://finance.yahoo.com/news/7-best-hotel-stocks-buy-213048296.html

[11] “Why Royal Caribbean and Carnival Stock Will Recover” September 30, 2022 https://www.thestreet.com/investing/why-royal-caribbean-carnival-stock-are-good-buys

[12]”Cruise ships are set to sail, but investors are wary” April 4, 2022 https://www.barrons.com/visual-stories/cruise-outlook-carnival-stock-2022-01648846207