19th Jan 2023

Like the rest of the travel industry, hotels were heavily hit by COVID-19, seeing occupancy rates drop below 20% and close to 5 million jobs disappearing from the sector in just a few months in 20201.

Hotel stocks plummeted, but many saw this as an opportunity to look for strong travel stocks to buy while prices were low. However, after several months of the travel recovery, is 2023 still a good time to invest in hotel stocks?

Hotel stocks have already bounced back

Hotels may have already experienced the sharpest gradient of the travel rebound. Many benefited from domestic travel before international travel resumed and long before cruise lines were permitted to restart.

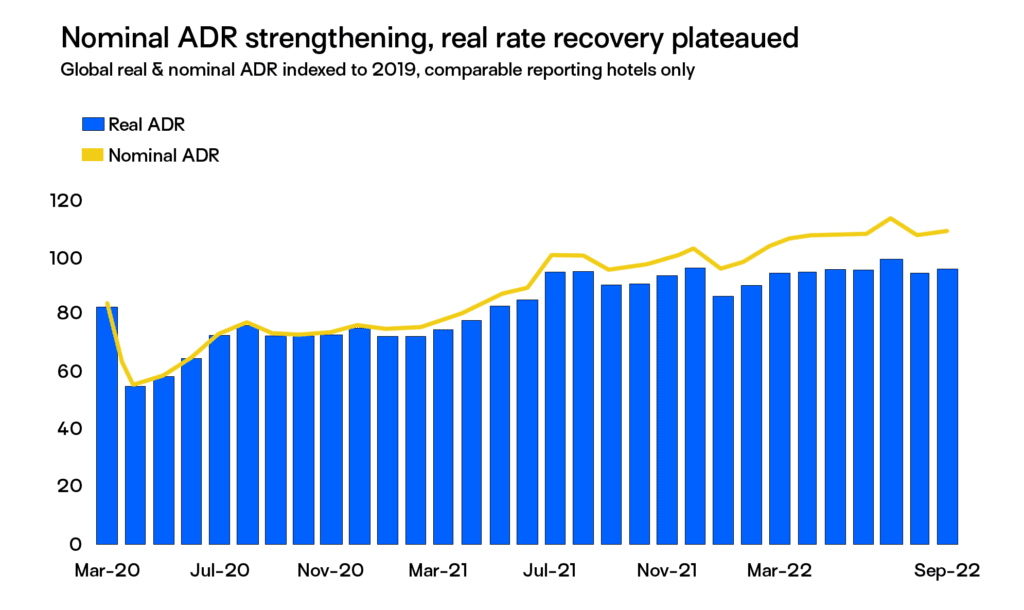

Global occupancy rates increased from 43% in January to 66% in September2, and hotels that reported data for both 2019 and 2022 showed that in September 2022, demand was just 6% short of pre-pandemic levels3. Meanwhile, average daily rate surpassed pre-pandemic levels4, and revenue per available room (RevPAR) hit record highs up nearly 108% over 2019 levels5.

But momentum began to slow. September was the fifth month in a row that saw demand remain relatively stable6, but many analysts still see potential profits waiting within hotel stocks.

There are still profits to be made from hotel stocks

Seeing hotels return to their seasonal rhythms is a positive sign that the market is stabilizing7. PwC analysts emphasize that daily hotel rates and revenue per room will continue to climb in 2023, but at a more measured pace, forecasting that ADR (average daily rate) will rise 4.5% and RevPAR will grow 5.8%8. The BAIRD/STR Hotel Stock Index is still down 5.5% from 2021, YTD, indicating that there is still plenty of room to grow9. Industry figures like AHLA President & CEO Chip Rogers are confident that growth will happen. “The hotel industry continues its march toward recovery, but we still have a way to go before we fully get there,” he said10.

There’s some concern that rising inflation could dampen the recovery, but it’s not seen as a serious worry. Amanda Hite, president of hospitality analytics firm STR, noted that, “While we continue to monitor the inflation impact and the likely recession, the resilience of the industry allowed us to maintain our previous projections for [average daily rate] and RevPAR.11” Manoj Dalmia, Founder & Director at Proficient Equities, notes that “despite rising bank interest rates, people have not curtailed their spending.12“

Although leisure travel demand is softening, lucrative business travelers are predicted to return in 2023. “We continue to see progress as business travel makes its way back to being a $1.4 trillion global industry, pre-pandemic,” said Suzanne Neufang, CEO, GBTA, adding “the industry is showing positive indicators and sentiment for 2023, a strong sign as business travel continues to come back over time.” A recent survey of business travel suppliers found that 85% expect more corporate bookings in 2023 and 80% expect higher corporate travel spending.13

As a result, 2023 could be an excellent time to buy hotel stocks that haven’t yet returned to their pre-pandemic strengths. Here are our recommendations for the top 5 hotel stocks for 2023.

1. Defiance Travel ETF (CRUZ)

Hotel stocks are expected to keep rising, but the recovery is uneven, with certain regions and travel markets bouncing back faster than others. This makes it tough to choose individual hotel stocks or even rely on a hotel ETF, and increases the appeal of a travel ETF like Defiance’s CRUZ, which enables investors to spread their investment across the broader hotel sector.

CRUZ is a wider travel ETF with holdings in leading airline, cruise, and hotel stocks, allowing investors to benefit from the travel recovery while mitigating exposure to risk. CRUZ tracks the rules-based weighted BlueStar Global Hotels, Airlines, and Cruises Index, has an expense ratio of 0.45%, and is currently trading at $15.9614.

2. Hilton Hotels Corporation (HLT)

Hilton is one of the world’s leading hotel brands, managing 18 brands and 6.400 properties worldwide. It barely faltered when the pandemic hit, continuing to expand into new regions while investing in hygiene and contact-free technology.

Hilton’s Q2 2022 earnings results revealed strong revenue growth across all business categories, with net income almost tripling15. Hilton’s brand reputation makes it a popular option for investors, who trust the management to deliver good stock performance16. Hilton is currently trading at $125.0317.

3. Marriott International Inc (MAR)

Marriott hotels is among the world’s largest hotel chains, presiding over more than 30 brands including popular resorts like Ritz-Carlton, Sheraton, and Courtyard Hotels. Like Hilton, it pivoted quickly to attract visitors even during the pandemic, and its strong brand recognition and broad portfolio add to its appeal among investors.

Marriott predicts that 2022 will have seen RevPAR grow 2-4% above 2019 levels, and reported revenue of $4.2 billion in Q2 2022, only slightly shy of pre-pandemic numbers18. Marriott is currently trading at $147.7519.

4. IHG Hotels & Resorts (IHG)

InterContinental is a UK-based hotel chain with properties all around the world. Towards the end of 2022, many considered it undervalued20, but the subsequent rush to buy IHG shares still leaves plenty of opportunity for decent returns for investors who buy now.

IHG is seen as a stable hotel stock, and is expected to grow revenue significantly over the next couple of years, with profits predicted to rise by 58%21. Investment bank Peel Hunt noted that the company owns 4% of the global hotels market, but 10% of the space currently being developed, allowing plenty of scope for it to grow its market share22. IHG is currently trading at £48.2223.

5. H World Group (formerly Huazhu Hotels Group) (HTHT)

Based in China with over 8,000 hotels, H World Group is a significant player in the hotel industry. With most of its hotels located in China, H World Group could benefit from the much-delayed reopening of the country, although the current surge in COVID-19 could temporarily dent its occupancy rates.

H World reported a 16.2% rise in revenue YOY in Q3 2022 and grew its turnover by 24.4% YOY, although losses were also significant, rising from RMB 137 million in Q3 2021 and RMB 350 million in Q2 022 to RMB 717 million in Q3 202224. It’s considered a volatile but potentially lucrative hotel stock to buy, with revenues expected to grow by 51% over the next few years25. HTHT is currently trading at $42.9026.

1 “Top Hotel Stocks” September 27, 2022 https://www.investopedia.com/top-hotel-stocks-5078914

2 “Tourism Recovery Accelerates to Reach 65% of Pre-Pandemic Levels” November 23, 2022 https://www.hotel-online.com/press_releases/release/tourism-recovery-accelerates-to-reach-65-of-pre-pandemic-levels/

3 “Global hotel demand recovery reached a pandemic-era high in September”

October 31, 2022 https://www.hospitalitynet.org/news/4113225.html

4 “Global hotel demand recovery reached a pandemic-era high in September”October 31, 2022 https://www.hospitalitynet.org/news/4113225.html

5 “PwC: ‘Headwinds’ Threaten 2023 U.S. Hotel Recovery Pace” November 21, 2022 https://www.businesstravelnews.com/Procurement/PwC-Headwinds-Threaten-2023-US-Hotel-Recovery-Pace

6 “Global hotel demand recovery reached a pandemic-era high in September”

October 31, 2022 https://www.hospitalitynet.org/news/4113225.html

7 “PwC: ‘Headwinds’ Threaten 2023 U.S. Hotel Recovery Pace” November 21, 2022 https://www.businesstravelnews.com/Procurement/PwC-Headwinds-Threaten-2023-US-Hotel-Recovery-Pace “Global hotel demand recovery reached a pandemic-era high in September” October 31, 2022 https://www.hospitalitynet.org/news/4113225.html

8 “PwC: ‘Headwinds’ Threaten 2023 U.S. Hotel Recovery Pace” November 21, 2022 https://www.businesstravelnews.com/Procurement/PwC-Headwinds-Threaten-2023-US-Hotel-Recovery-Pace

9 “Investor Confidence in Hotel Sector Holds” December 14, 2022 https://www.costar.com/article/1491554071/investor-confidence-in-hotel-sector-holds

10 “Analysis: 2022 Hotel Leisure Travel Revenue Projected To Be Up 14% Over Pre-Pandemic Levels” October 17, 2022 https://www.hotel-online.com/press_releases/release/analysis-2022-hotel-leisure-travel-revenue-projected-to-be-up-14-over-pre-pandemic-levels/

11 “Investor Confidence in Hotel Sector Holds” December 14, 2022 https://www.costar.com/article/1491554071/investor-confidence-in-hotel-sector-holds

12 “Why hotel stocks are skyrocketing? Experts list out these stocks to buy” September 22, 2022 https://www.livemint.com/market/stock-market-news/why-hotel-stocks-are-skyrocketing-experts-list-out-these-stocks-to-buy-11663831442990.html

13 “Business Travel Continues Bouncing Back With a Strong Outlook for 2023, According to New Industry Poll From GBTA” October 7, 2022 https://www.hotel-online.com/press_releases/release/business-travel-continues-bouncing-back-with-a-strong-outlook-for-2023-according-to-new-industry-poll-from-gbta/

14 Accessed January 4, 2023 https://www.defianceetfs.com/cruz/

15 “Top Hotel Stocks” September 27, 2022 https://www.investopedia.com/top-hotel-stocks-5078914

16 “Best hotel stocks to buy in 2023” December 6, 2022 https://invezz.com/stocks/best/hotel/

17 Accessed January 4, 2023 https://www.google.com/search?q=hilton+stock+price&oq=hilton+stock+price&aqs=chrome..69i57j0i512l2j0i22i30l7.2832j0j4&sourceid=chrome&ie=UTF-8

1 “7 Best Hotel Stocks to Buy Now” November 22, 2022 https://finance.yahoo.com/news/7-best-hotel-stocks-buy-213048296.html

19 Accessed January 4, 2023 https://www.google.com/search?q=marriott+stock+price&ei=_ki1Y4K2McjgkdUPrt-ngAI&oq=hilton+stock+price&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQAxgAMgoIABBHENYEELADMgoIABBHENYEELADMgoIABBHENYEELADMgoIABBHENYEELADMgoIABBHENYEELADMgoIABBHENYEELADMgoIABBHENYEELADMgoIABBHENYEELADMgcIABCwAxBDMgcIABCwAxBDSgQIQRgASgQIRhgAUABYAGC-C2gCcAF4AIABAIgBAJIBAJgBAMgBCsABAQ&sclient=gws-wiz-serp

20 “Market report: ‘Undervalued’ InterContinental stock attracts positive reviews” December 9, 2022 https://www.thetimes.co.uk/article/market-report-undervalued-intercontinental-stock-attracts-positive-reviews-rp6gpcwd9 “Is Now An Opportune Moment To Examine InterContinental Hotels Group PLC (LON:IHG)?” December 13, 2022 https://finance.yahoo.com/news/now-opportune-moment-examine-intercontinental-122605192.html

21 “Is Now An Opportune Moment To Examine InterContinental Hotels Group PLC (LON:IHG)?” December 13, 2022 https://finance.yahoo.com/news/now-opportune-moment-examine-intercontinental-122605192.html

22 “Market report: ‘Undervalued’ InterContinental stock attracts positive reviews” December 9, 2022 https://www.thetimes.co.uk/article/market-report-undervalued-intercontinental-stock-attracts-positive-reviews-rp6gpcwd9

23 Accessed January 4, 2023 https://www.google.com/search?q=IHG+stock+price&ei=Zkq1Y_SFPNizkdUP4dOogAI&ved=0ahUKEwj00Ke00K38AhXYWaQEHeEpCiAQ4dUDCA8&uact=5&oq=IHG+stock+price&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQAzIGCAAQBxAeMgYIABAHEB4yBggAEAcQHjINCAAQBxAeEA8Q8QQQCjIHCAAQgAQQDTIHCAAQgAQQDTIECAAQHjIECAAQHjIECAAQHjIFCAAQhgM6CggAEEcQ1gQQsAM6BwgAELADEEM6CAgAEAcQHhAPOgoIABAHEB4QDxAKSgQIQRgASgQIRhgAUKEHWNwKYIUPaAJwAXgAgAGUAYgBrgSSAQMwLjSYAQCgAQHIAQrAAQE&sclient=gws-wiz-serp

24 “H World Group Limited Reports Third Quarter of 2022 Unaudited Financial Results” November 28, 2022 https://www.globenewswire.com/news-release/2022/11/28/2562939/19355/en/H-World-Group-Limited-Reports-Third-Quarter-of-2022-Unaudited-Financial-Results.html

25 “Should You Think About Buying H World Group Limited (NASDAQ:HTHT) Now?” December 27, 2022 https://simplywall.st/stocks/us/consumer-services/nasdaq-htht/h-world-group/news/should-you-think-about-buying-h-world-group-limited-nasdaqht

26 Accessed January 4, 2023 https://www.google.com/search?q=htht+stock+price&oq=htht+stock+price&aqs=chrome..69i57l4j0i271j69i60l3.1839j0j9&sourceid=chrome&ie=UTF-8