ETFs built for the

next generation™

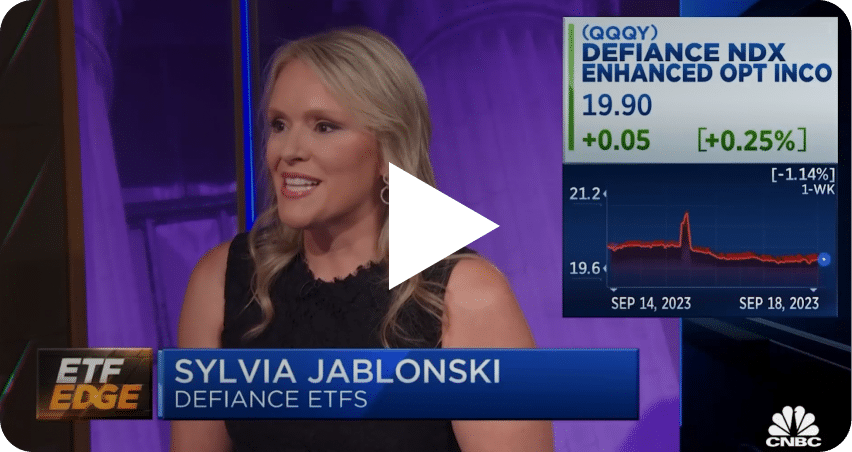

As Seen In

Leading the wave of thematic & income investing

Founded in 2018, Defiance stands as a leading ETF sponsor dedicated to income and thematic investing. Our actively managed options ETFs are designed to enhance income while our suite of first-mover thematic ETFs empower investors to express targeted views on dynamic sectors leading the way in disruptive innovations, including artificial intelligence, machine learning, quantum computing, 5G, and hydrogen energy.