6th Feb 2023

Investors who kept faith in travel stocks during the turmoil of COVID-19 are feeling vindicated, as people pack their suitcases once more. More cautious investors are considering which travel stocks to buy, with a travel ETF like CRUZ from Defiance, which offers broad exposure to the entire sector, presenting particular appeal.

Travelers won’t be kept at home

2022’s travel numbers are encouraging for anyone investing in travel stocks. The UN World Tourism Organization (UNWTO) estimates that 700 million people traveled internationally between January and September 2022, putting the sector on course to reach 65% of its pre-pandemic levels, and tourism revenues reached as high as $1.3 trillion, or 70-80% of 2019 numbers.1

More importantly, this trend is set to continue. A survey for the World Travel and Tourism Council (WTTC) found that 63% of consumers are planning a leisure trip in the next 12 months, with 27% intending to take 3 or more2. Hotels and airline stocks paint a similar picture, with 61% of Americans responding to an American Hotel & Lodging Association (AHLA) survey saying they would take more vacations in 2023 than in 20223, and the International Air Transport Association (IATA) predicting that 2023 will be the first profitable year for airlines since 20194.

Prices are up, but so is spending

There are concerns that inflation and high energy prices could knock the travel industry down just as it peeks above the parapet5, with the UNWTO Panel of Tourism Experts downgrading confidence towards the end of 20226, but so far evidence on the ground belies the pessimism. Travelers are spending more at vacation destinations, with inbound tourism spending rising 112% over 2021 levels and predicted to exceed $1.4 trillion globally in 20237.

Airline prices were 43% higher in October 2022 than October 20218, but demand isn’t slowing. Hotels have all raised room rates, but David Kolner, executive VP at Virtuoso, doesn’t see that as a problem. “I don’t think there’s a single member agency that would say it has seen any indication of demand slowing down at all while the pricing increases,” he explained, adding “I don’t think anyone’s going to have to lower their prices.”9

It’s a similar story on the seas. Ann Chamberlin, U.S. VP of sales for Scenic and Emerald Cruises, reports high demand for luxury cruises, saying “People feel that it’s their time, and they’re going to book what they want — and we’re seeing it in the numbers with the higher-end categories definitely booking first.”10 Norwegian Cruise Lines (NYSE: NCLH) is benefiting from the carpe diem atmosphere, with CEO Frank Del Rio’s pricing strategy of “high value over low price” paying off with increased occupancy and revenue.11

Business travel is coming on board again

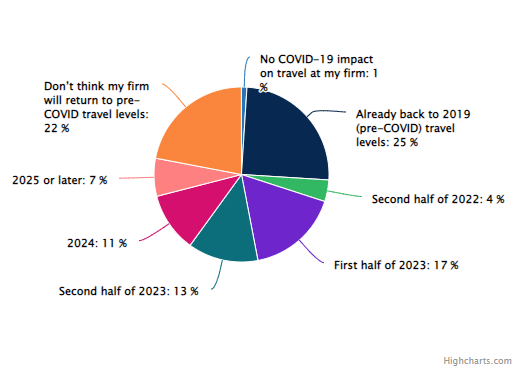

Business travel has historically been more lucrative than leisure travel, but takes longer to recover after a crisis, so investors are eager for signs that business travelers are returning. Ravi Shankar, Morgan Stanley’s analyst for travel in North America, predicts that 2023 will see business travel budgets nearly back to “normal” and even exceeding 2019 levels.12

Hotels in particular are awaiting the return of business visitors. After an initial sharp recovery in 2022, leisure demand is softening. PwC analysts “expect demand growth from individual business travelers and groups to continue to offset” this change. 13

Labor issues continue, but aren’t an obstacle

Labor shortages represent a potentially more serious monkey wrench for travel stocks, especially after months of “travel chaos” at airports. However, it seems that airlines have learned their lesson. US airlines hired approximately 38,000 extra workers in 2022, and the total workforce numbered almost 494,000 by September 2022, 3.6% more than in September 2019.14

Hotels are experiencing similar challenges. An AHLA survey in September 2022 found that 87% of properties are short-staffed, with 36% reporting severe shortages. As alarming as this sounds, it’s an improvement on May 2022, when the figures were 97% and 49% respectively.15 In Europe, where labor costs are rising, payroll per available room (PAR) in September 2022 was €3 higher than in September 2019. Together with high energy and utilities bills, this could dent profits, but so far global profit margins are at 42%, equal to or higher than 2019 levels.16

Airlines are optimistic

The four major airline stocks are still down over the past year17, but the metrics are positive for 2023, so travel investors focusing on airline stocks or an airline ETF can take heart. Shankar predicts that 2023 could be the “Goldilocks year” for US airlines, but the market hasn’t yet priced that in18, so this could be a good time to buy airline stocks. “The recovery is going well,” declared Willie Walsh, director-general of IATA.19

Delta Air Lines, Inc (NYSE: DAL) reported record revenues in Q3 2022, beating market estimates by $360 million20, and expects Q4 revenue to exceed 2019 levels by 5%-9%21. CEO Ed Bastien says “there’s nothing that gives me pause to think that this momentum isn’t going to continue.22” Southwest Airlines (NYSE: LUV) is confident enough to have reinstated dividends, making it the first airline to do so23, and United Airlines’ Q3 2022 earnings beat analyst expectations and its pre-pandemic record.24

Hotels are hitting their stride

While the sharp rebound of 2022 is starting to soften, hotel stocks investors needn’t worry: as leisure travel growth slows down, business and group travel25 is speeding up. Many hotel stocks will benefit from China re-opening26, and with the hotel stock index down 5.5% from 202127, this may be just the opportunity investors have been looking for.

2022 ended with occupancy still slightly below pre-pandemic levels, but RevPAR (revenue generated per available room, whether or not they are occupied) and ADR (average daily rate) both exceeding it, which bodes well for any hotel ETF investors28. Hotels giant Marriott fits the model, reporting $4.2 billion in revenue Q2 2022, only slightly below 2019 levels, and expecting 2022 RevPAR to end 2-4% above pre-pandemic numbers29.

Cruise stocks are entering clear water

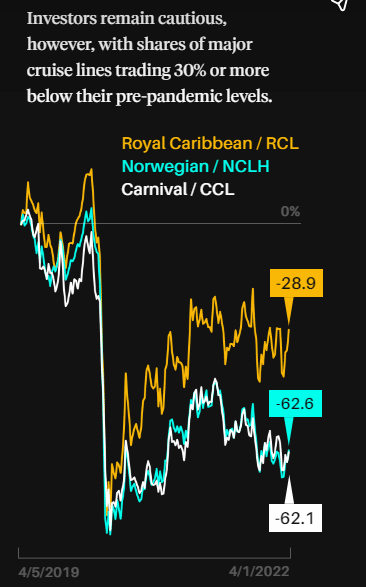

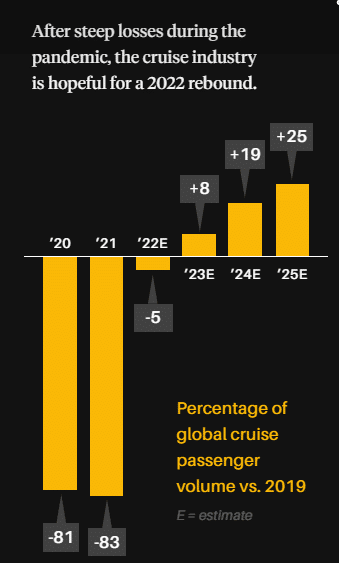

As a result of the extended wait for reopening, even some of the most well-capitalized cruise stocks enter 2023 with a significant debt burden, so meaningful returns may take time to arrive. However, customers are returning to cruise ships in droves, helped by the desire for luxury, so the outlook is positive. Daniel Kline, managing editor for The Street, writes that “these are strong companies built for the long-term that made a lot of money before the pandemic and should do so again”30

These predictions could make this an excellent time to buy into a cruise ETF, after Carnival’s (NYSE: CCL) disappointing Q3 2022 earnings report dragged down stock prices for all cruise stocks.31 Major cruise stocks are still trading 30% or more below pre-pandemic levels, but passenger volume in 2023 is expected to exceed that of 2019 by 8%, so investors may wish to buy in the dip.32

Source: Cruise ships are set to sail, but investors are wary” April 4, 2022 https://www.barrons.com/visual-stories/cruise-outlook-carnival-stock-2022-01648846207

Norwegian Cruises is a case in point. Stock prices are 70% below the pre-pandemic high33, but occupancy and revenue grew significantly in 202234, and onboard revenue generation jumped to a record high35. The company expects occupancy to return to 2019 levels by Q2 202336 and plans to introduce eight more ships through 2027.37

2023 could be the year of the travel stock

The travel recovery isn’t expected to continue at the same explosive pace indefinitely, but it’s a healthy sign that travel is returning to pre-pandemic norms. Euromonitor International predicts that international travel will grow by 40% in 2023, in contrast to the 80% seen in 2022, but emphasizes that trip volume is still rising.38 The forecast was made before China announced that it was abandoning its zero-covid policy, so the return of Chinese tourists is likely to push these numbers higher.

Overall, after a turbulent but broadly positive 2022, 2023 could be the year that travel investing takes off. For investors who are looking for a way to invest in the travel recovery without trying to identify the best travel stocks to buy, a travel ETF like CRUZ tracks the rules-based weighted BlueStar Global Hotels, Airlines, and Cruises Index, including holdings in major airline, hotel, cruise, and general travel-related stocks.

As of this writing the following stocks mentioned are current holdings of Defiance’s ETF, CRUZ:

MARRIOTT INTL INC NEW (NYSE: MAR), DELTA AIR LINES INC DEL (NYSE: DAL), CARNIVAL CORP (NYSE: CCL), ROYAL CARIBBEAN GROUP (NYSE: RCL), SOUTHWEST AIRLS CO (NYSE: LUV), UNITED AIRLS HLDGS INC (NYSE: UAL), NORWEGIAN CRUISE LINE HLDG LTD SHS (NYSE: NCLH).

For current performance and holdings, please visit defianceetfs.com/CRUZ

1 “Tourism Recovery Accelerates to Reach 65% of Pre-Pandemic Levels” November 23, 2022 https://www.hotel-online.com/press_releases/release/tourism-recovery-accelerates-to-reach-65-of-pre-pandemic-levels/

2 “Global Traveller Survey Reveals International Travel Is Back” November 28, 2022 https://www.hotel-online.com/press_releases/release/global-traveller-survey-reveals-international-travel-is-back/

3 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.travelagewest.com/Industry-Insight/Business-Features/travel-trends-2023

4 “Airlines will return to profitability in 2023 after three-year slump, industry body says” December 6, 2022 https://www.cnbc.com/2022/12/06/airlines-will-return-to-profitability-in-2023-after-three-year-slump-iata.html

5 “Airline stocks can’t break free from recession anxiety despite positive 2023 setup” December 7, 2022 https://seekingalpha.com/news/3914939-airline-stocks-cant-break-free-from-recession-anxiety-despite-positive-2023-setup

“The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

6 “Tourism Recovery Accelerates to Reach 65% of Pre-Pandemic Levels” November 23, 2022 https://www.hotel-online.com/press_releases/release/tourism-recovery-accelerates-to-reach-65-of-pre-pandemic-levels/

7 “Despite Recession Fears, Tourist Spending Is Expected to Grow in 2023” December 14, 2022 https://www.bloomberg.com/news/articles/2022-12-14/despite-recession-fears-tourist-spending-will-grow-on-in-2023-report

8 “Is American Airlines Stock A Buy As Airline Traffic And Airfares Pick Up As Holidays Approach?” December 2, 2022 https://www.investors.com/research/aal-stock-buy-now/

9 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.travelagewest.com/Industry-Insight/Business-Features/travel-trends-2023

10 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.travelagewest.com/Industry-Insight/Business-Features/travel-trends-2023

11 “Here’s Why Investors Should Retain Norwegian Cruise (NCLH) Now” December 8, 2022 https://www.nasdaq.com/articles/heres-why-investors-should-retain-norwegian-cruise-nclh-now-0

12 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.morganstanley.com/ideas/business-travel-trends-2023-outlook

13 “PwC: ‘Headwinds’ Threaten 2023 U.S. Hotel Recovery Pace” November 21, 2022 https://www.businesstravelnews.com/Procurement/PwC-Headwinds-Threaten-2023-US-Hotel-Recovery-Pace

14 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.travelagewest.com/Industry-Insight/Business-Features/travel-trends-2023

15 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.travelagewest.com/Industry-Insight/Business-Features/travel-trends-2023

16 “Hotel Performance Pushes Back to Seasonal Patterns” October 31, 2022 https://www.hotel-online.com/press_releases/release/hotel-performance-pushes-back-to-seasonal-patterns/

17 “4 Airline Stocks To Watch in 2022” December 9, 2022 https://www.gobankingrates.com/investing/stocks/best-airline-stocks-to-invest-in/

18 “Airline stocks can’t break free from recession anxiety despite positive 2023 setup” December 7, 2022 https://seekingalpha.com/news/3914939-airline-stocks-cant-break-free-from-recession-anxiety-despite-positive-2023-setup

19 “Airlines will return to profitability in 2023 after three-year slump, industry body says” December 6, 2022 https://www.cnbc.com/2022/12/06/airlines-will-return-to-profitability-in-2023-after-three-year-slump-iata.html

20 “5 Best Airline Stocks To Buy Now” November 8, 2022 https://www.insidermonkey.com/blog/5-best-airline-stocks-to-buy-now-5-1084503/5/

21 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

22 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

23 “Top Stocks To Buy Now? 3 Airline Stocks In Focus” December 14, 2022 https://www.nasdaq.com/articles/top-stocks-to-buy-now-3-airline-stocks-in-focus

24 “The Travel Recovery Is Here (Yes, Really)” December 1, 2022 https://finance.yahoo.com/news/travel-recovery-yes-really-201108808.html

25 “13 Top Travel Trends to Know for 2023” November 28, 2022 https://www.travelagewest.com/Industry-Insight/Business-Features/travel-trends-2023

26 “Hotel stocks normally benefit from large airline cancellations like Southwest, says Truist’s Scholes” December 28, 2022 https://www.cnbc.com/video/2022/12/28/hotel-stocks-normally-benefit-from-large-airline-cancellations-like-southwest-says-truists-scholes.html

27 “Investor Confidence in Hotel Sector Holds” December 14, 2022 https://www.costar.com/article/1491554071/investor-confidence-in-hotel-sector-holds

28 “7 Best Hotel Stocks to Buy Now” November 22, 2022 https://finance.yahoo.com/news/7-best-hotel-stocks-buy-213048296.html

29 “7 Best Hotel Stocks to Buy Now” November 22, 2022 https://finance.yahoo.com/news/7-best-hotel-stocks-buy-213048296.html

30 “Why Royal Caribbean and Carnival Stock Will Recover” September 30, 2022 https://www.thestreet.com/investing/why-royal-caribbean-carnival-stock-are-good-buys

31 “Why Carnival and Other Cruise Line Stocks Are Bouncing Back Today” October 4, 2022 https://www.fool.com/investing/2022/10/04/why-carnival-and-other-cruise-line-stocks-are-boun/

32 “Cruise ships are set to sail, but investors are wary” April 4, 2022 https://www.barrons.com/visual-stories/cruise-outlook-carnival-stock-2022-01648846207

33 “Why You Should Buy the Dip on This Cruise Line Stock” November 21, 2022 https://www.fool.com/investing/2022/11/21/why-you-should-buy-the-dip-on-this-cruise-line-sto/

34 “Here’s Why Investors Should Retain Norwegian Cruise (NCLH) Now” December 8, 2022 https://www.nasdaq.com/articles/heres-why-investors-should-retain-norwegian-cruise-nclh-now-0

35 “Why You Should Buy the Dip on This Cruise Line Stock” November 21, 2022 https://www.fool.com/investing/2022/11/21/why-you-should-buy-the-dip-on-this-cruise-line-sto/

36 “Here’s Why Investors Should Retain Norwegian Cruise (NCLH) Now” December 8, 2022 https://www.nasdaq.com/articles/heres-why-investors-should-retain-norwegian-cruise-nclh-now-0

37 “Here’s Why Investors Should Retain Norwegian Cruise (NCLH) Now” December 8, 2022 https://www.nasdaq.com/articles/heres-why-investors-should-retain-norwegian-cruise-nclh-now-0

38 “Despite Recession Fears, Tourist Spending Is Expected to Grow in 2023” December 14, 2022 https://www.bloomberg.com/news/articles/2022-12-14/despite-recession-fears-tourist-spending-will-grow-on-in-2023-report